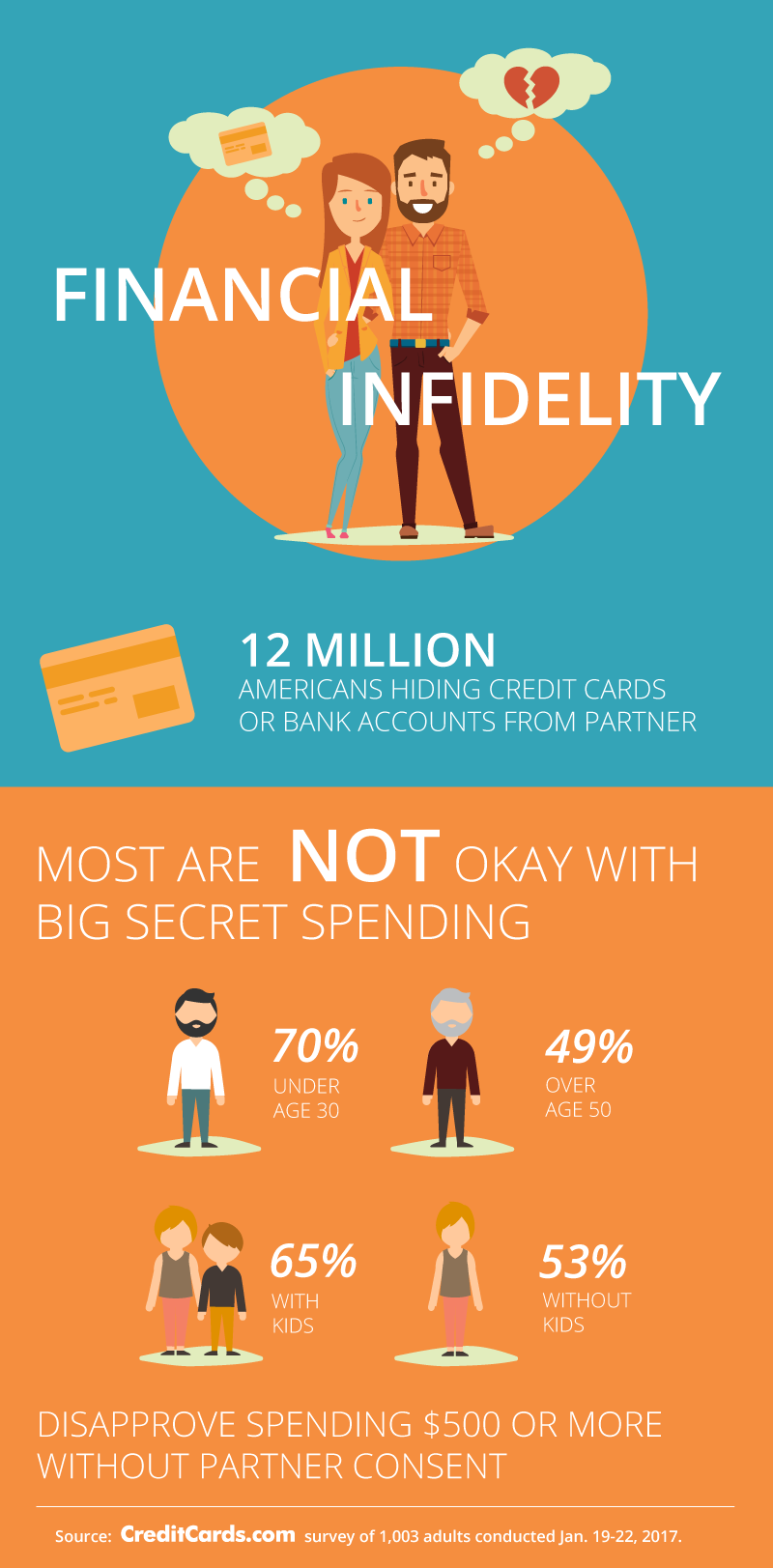

Approximately 12 million Americans have concealed a bank or credit card account from their live-in spouse, partner or significant other, according to a new CreditCards.com survey.

Age appears to be a factor in financial infidelity wherein older Baby Boomers (11%), those ages 63-71, are nearly four times as likely as Millennials to have had a secret account (3%).

“Keeping secrets in your relationships is never a good idea,” said Matt Schulz, senior industry analyst at CreditCards.com. “Like any indiscretion, what starts out small tends to build. Spending $25 without consulting your partner may seem incidental, but when those purchases become more frequent or if the amount grows, it can wreak havoc on your accounts and your budget.”

http://www.creditcards.com/credit-card-news/financial-infidelity-poll-hidden-account.php

Regardless of the potential financial risk, some Americans don’t appear discouraged from making large purchases on their own. More than 1 in 4 of respondents (28%) have admitted to spending $500 or more without consulting their partner. Baby Boomers (39%) are nearly twice as likely to spend this amount compared to millennials (20%).

Americans seem to be all right with their partner spending large amounts of money without their consent. One-third (33%) of respondents think it is fine for their significant other to spend $500 or more without asking. This was the most popular answer. Males, Republicans and those with an income of over $75K were most likely to feel this way.

Spending large amounts without a prior discussion is not all right with everyone. 20% of Americans report spending less than $25 without first speaking with their partner. Parents (29%) were nearly twice as likely to state this compared to non-parents (15%).

CreditCards.com commissioned Princeton Survey Research Associates International to conduct the survey. PSRAI obtained telephone interviews with a nationally representative sample of 1,003 adults, including 706 adults living with a spouse or partner, living in the continental United States. Interviews were conducted by landline (502) and cellphone (501, including 312 without a landline phone) in English and Spanish Jan. 19-22, 2017. Statistical results are weighted to correct known demographic discrepancies. The margin of the sampling error for the original complete set of weighted data is plus or minus 3.7 percentage points and plus or minus 4.3 percentage points for respondents living with a significant other.

About CreditCards.com:

CreditCards.com is a leading online credit card marketplace, bringing consumers and credit card issuers together. At its free website, consumers can compare hundreds of credit card offers from America’s leading issuers and banks and apply securely, online. CreditCards.com is also a destination site for consumers wanting to learn more about credit cards. Offering advice, news, features, statistics and tools, CreditCards.com helps consumers make smart choices about credit cards. In 2016, over 35 million unique visitors used CreditCards.com to find the right credit card to suit their needs.

For More Information:

Kayleen (Katie) Yates

VP, Corporate Communications

(917) 368-8677

kyates@bankrate.com

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/12-million-americans-have-concealed-bank-and-credit-card-accounts-300404079.html

SOURCE CreditCards.com

Related Photos: Photo,

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs